Simple money transfer or application to a credit loan. Hundreds of banking transactions can be automated by A.I. without the need of live agents; This is the new definition of efficiency for the banking industry.

Majority of banking transactions can be executed without the need of live agents but the use of self service in the banking industry is merely sufficient. This is contradictory since increasing self-service rates results in major improvements in customer experience and significant savings on operational costs for banks.

Banking bots can execute hundreds of banking transactions for customers. When this is the case, simple tasks are automated by technology while the most valuable asset at call centers, agent time, can be saved to focus more on customers.

In partnership with Sestek, VakıfBank developed a smart banking bot that interacts with customers via text and natural speech.

ViBi INCREASES NUMBER OF SELF-SERVICE TRANSACTIONS

CUSTOMERS EXECUTE 150K TRANSACTIONS DAILY USING ViBi

CREDIT APPLICATIONS SUBMITTED VIA ViBi ANNUALLY

“ViBi became a best practice in the sector, both with its contributions to customer engagement and self-service rates. Considering long-term IT investments, we completed and launched the project only in 6 months. This is the result of a successful collaboration between VakıfBank and Sestek teams.”

DIRECTOR OF DIGITAL BANKING - VAKIFBANK

Enabling customers execute banking transactions 24/7 without the need of live assistance has significant impact on customer experience and operational efficiency. Distribution of customer service around-the-clock is advantageous for both customers and agents.

Banking bots can be deployed in multiple service channels to provide the same level of service quality to customers. Whether it is a WhatsApp chat or mobile application interface, customers are presented with a consistent, improved experience.

Agent time is the most valuable asset in customer service. Banking bots helping customers for simple transactions save this valuable asset. Repetitive, daily tasks are automated while agents can work on solving more complex issues for customers.

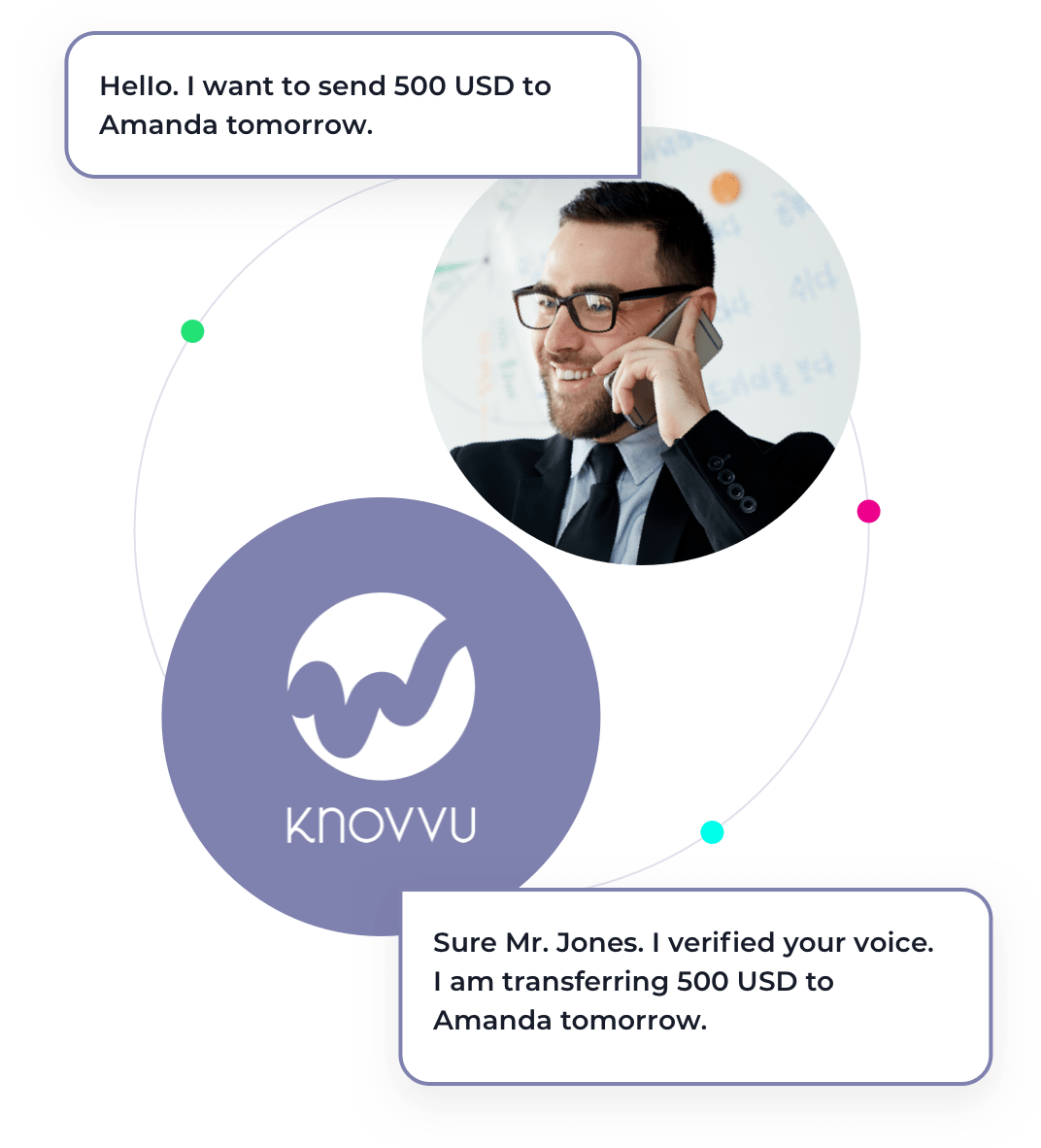

With 100% in-house developed Speech Recognition (SR) and Natural Language Understanding (NLU) technologies, Knovvu Virtual Agent understands customer intent and responds without the need for live agents. Our market-leading speech recognition accuracy rate enables Knovvu Virtual Agent to effectively automate simple tasks, help increase self-service and decrease costs for customer service operations.

Let’s go into detail on how Knovvu’s conversational solutions can improve your agent and customer experience.